How did a large Norwegian tanker operator virtually eliminate cash-to-master?

CHALLENGE

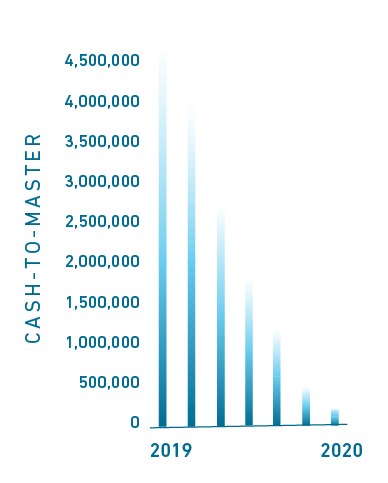

Odfjell operates more than 80 ships that move volatile materials by sea. In any given month, each ship was carrying an average of $30,000 in cash and Odfjell was processing $4-5 million in cash-to-master transactions annually.

The company needed a solution that could reduce costs, increase security and improve logistics, but a brief and unsuccessful partnership with a ShipMoney competitor left their Filipino crew members understandably skeptical about digital payments.

Read below how did this large Norwegian tanker operator virtually eliminate cash-to-master.

SOLUTION

After ShipMoney was able to gain buy-in from both crew and management to reintroduce digital payments, every crew member was given access to the ShipMoney mobile app, a physical debit card and virtual card for contactless payments. Over four months, Odfjell was able to reduce on-board cash by millions, reduce international transfer fees, make payday simpler and more predictable, and put millions in operating capital back to work instead of sitting on ships. The ships themselves also overcame challenges, such as renegotiating with local, cash-based suppliers to accept card payments wherever possible.

RESULTS

Odfjell has benefited greatly by adopting ShipMoney. Cash-to-master payments are at the lowest levels ever, and each ship now carries just a few hundred dollars in cash. This has reduced costs and ad-hoc processes, increased security, and improved operational efficiency.

Likewise, crew members have fully embraced ShipMoney, which gives them more control over their money, immediate access to funds, and multiple ways to send money to family and friends. Recently, Odfjell removed the final tranche of on-board cash rather than disperse it, because crew members said they preferred using their ShipMoney cards.